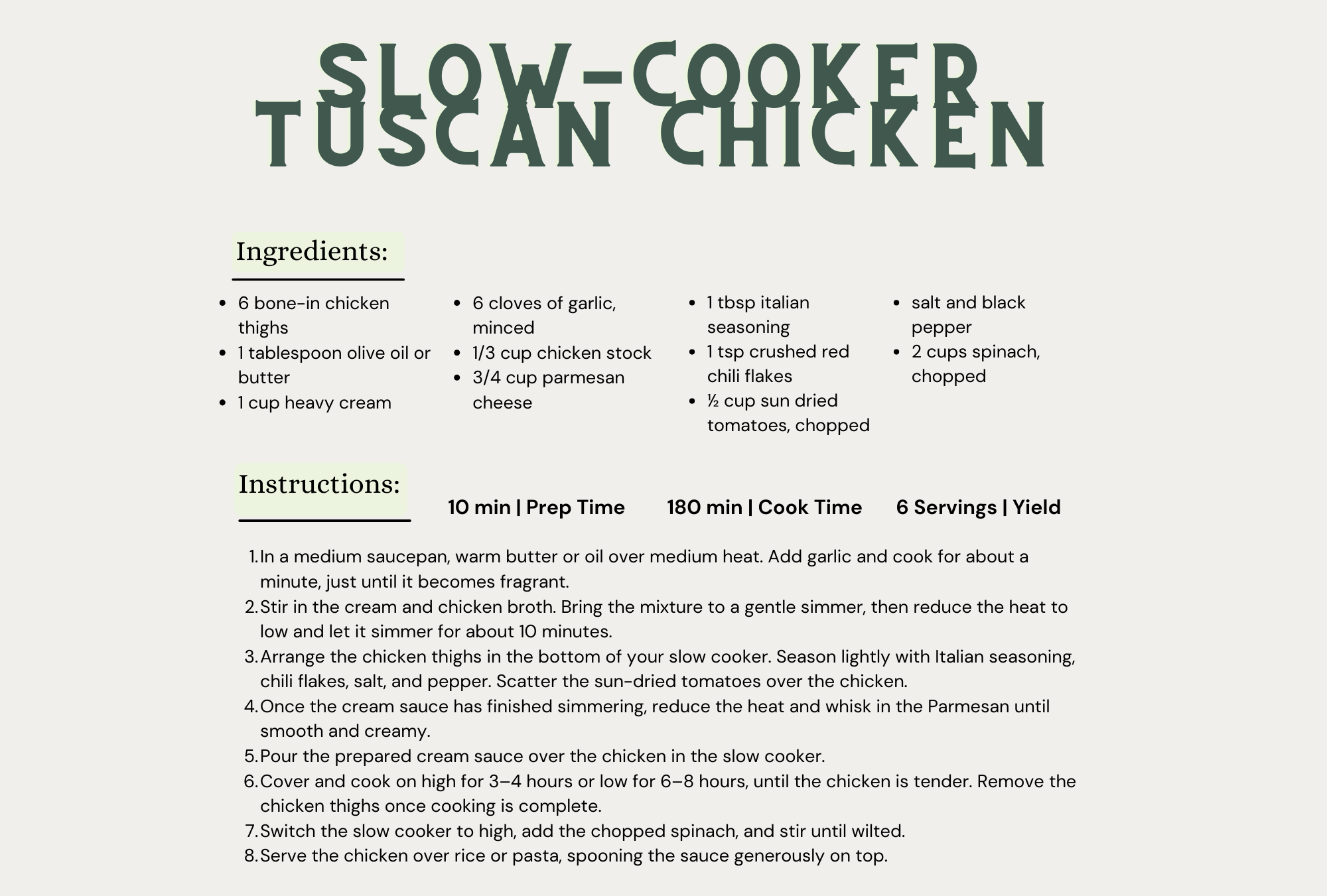

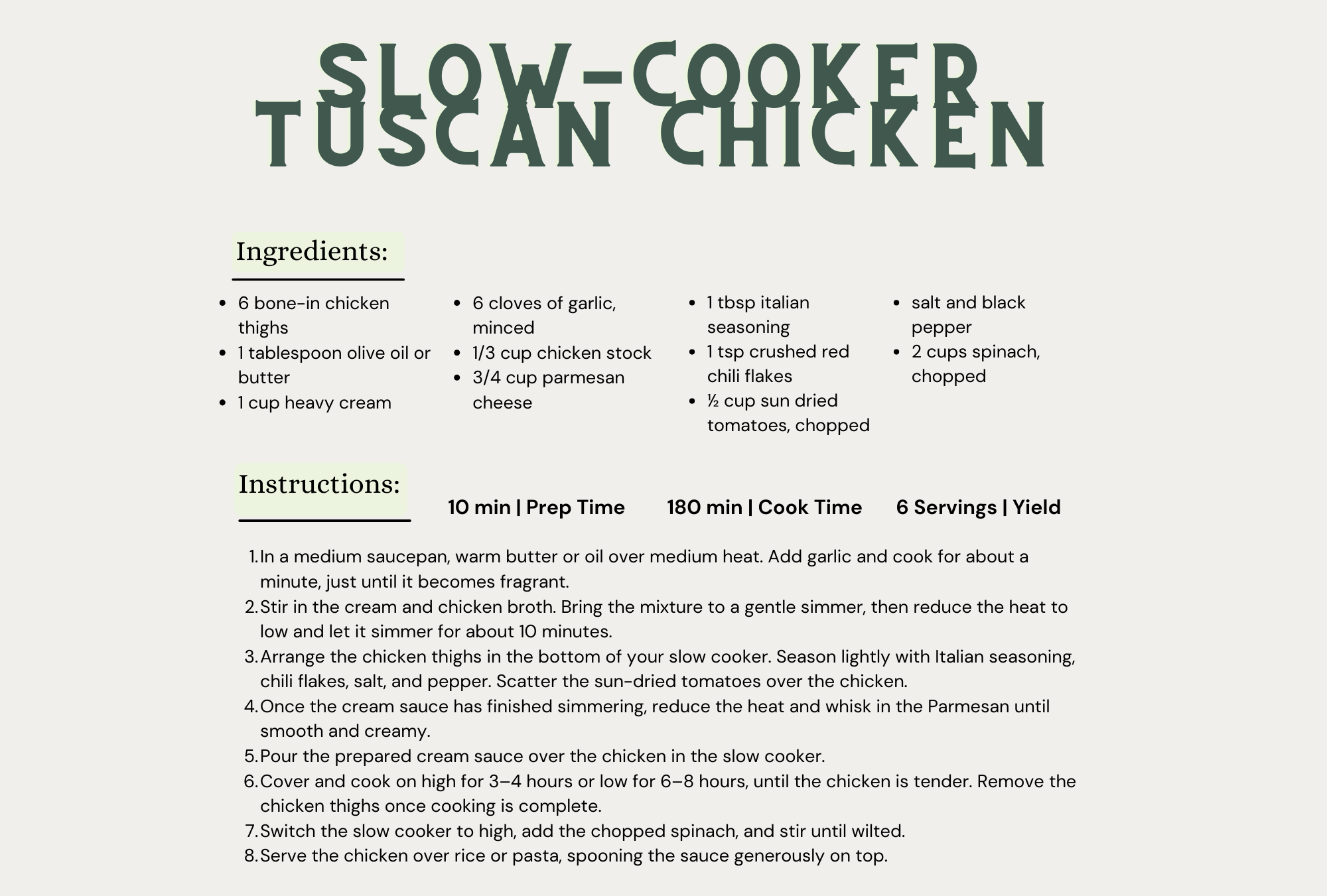

Creamy, garlicky, and loaded with sun-dried tomatoes & spinach. The kind of “set it and forget it” meal that makes the house smell heavenly.

Crisp, bubbly and just sweet enough. Perfect for sipping while the chicken does it’s thing.

Creamy, garlicky, and loaded with sun-dried tomatoes & spinach. The kind of “set it and forget it” meal that makes the house smell heavenly.

Crisp, bubbly and just sweet enough. Perfect for sipping while the chicken does it’s thing.

As summer winds down and cooler days start to roll in, September is the perfect month to tackle some home maintenance tasks. A little preparation now will help you transition smoothly into fall while keeping your home safe, comfortable, and organized. Here are some essential September home maintenance tips:

Fall is a crucial time for lawn care. Applying fertilizer in September helps grass develop stronger roots before winter sets in, giving you a healthier, greener lawn come spring. Look for a slow-release fertilizer designed for fall, and water your lawn afterward to help nutrients absorb.

Check the batteries and functionality of your smoke detectors, carbon monoxide detectors, and fire extinguishers. These simple tests can make all the difference in an emergency. If your devices are more than 10 years old, it may be time to replace them.

Before the chilly weather arrives, schedule a professional inspection of your furnace or heating system. Regular servicing improves efficiency, reduces energy costs, and ensures your system is ready to keep you warm when you need it most.

With seasonal gear about to change, now is a great time to sort through closets, the garage, and storage rooms. Donate or recycle items you no longer need and organize fall essentials like coats, boots, and holiday décor so they’re easy to access.

Dust can build up on fan blades over summer, so give them a good cleaning. Then, switch your ceiling fans to spin clockwise on a low setting—this helps circulate warm air downward during cooler months, improving comfort and efficiency.

By taking care of these maintenance tasks in September, you’ll be setting your home up for a safe, cozy, and stress-free fall season. A little effort now can save you time, money, and hassle later!

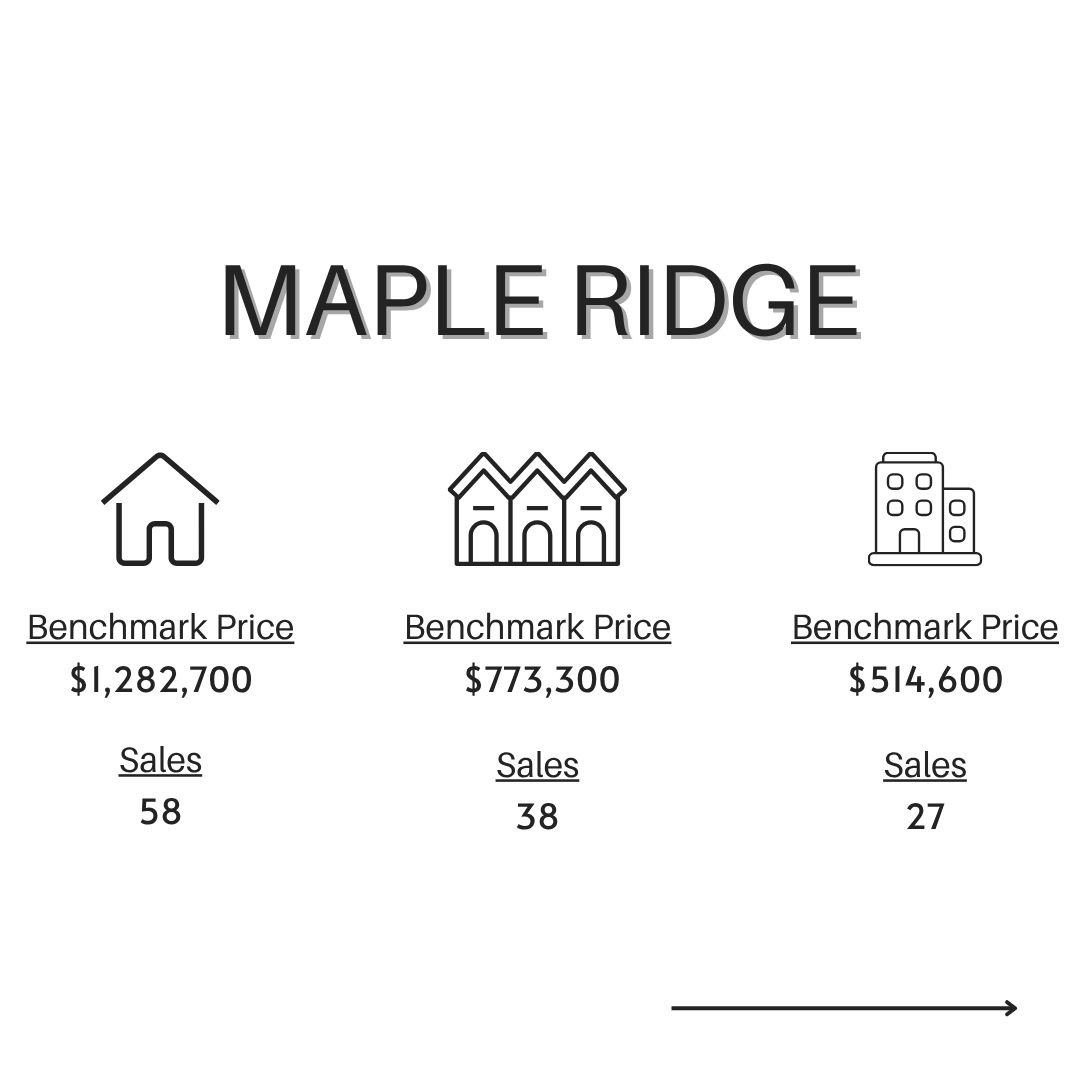

Vancouver Real Estate Market Update – August 2025

Home Sales: 1,959 (-2.9% YoY)

New Listings: 4,225 (+2.8% YoY)

Total Listings: 16,242 (+17.6% YoY)

Benchmark Price: $1.150M (-3.8% YoY, -1.3% MoM)

Market Insights:

Sales-to-active listings ratio: 12.4% → Balanced market

Detached home price: $1.950M (-4.8% YoY)

Apartment price: $734K (-4.4% YoY)

Attached home price: $1.079M (-3.5% YoY)

2025 Outlook:

August sales numbers show that Metro Vancouver’s housing market is slowly bouncing back after a tough first half of the year. Detached and attached home sales are up over 10% compared to last August, which suggests more buyers are stepping back into higher price ranges. Prices have dipped about 2% since January and 1% from July to August, showing that sellers are adjusting their expectations. With buyers and sellers more in sync, sales activity has started to pick up.

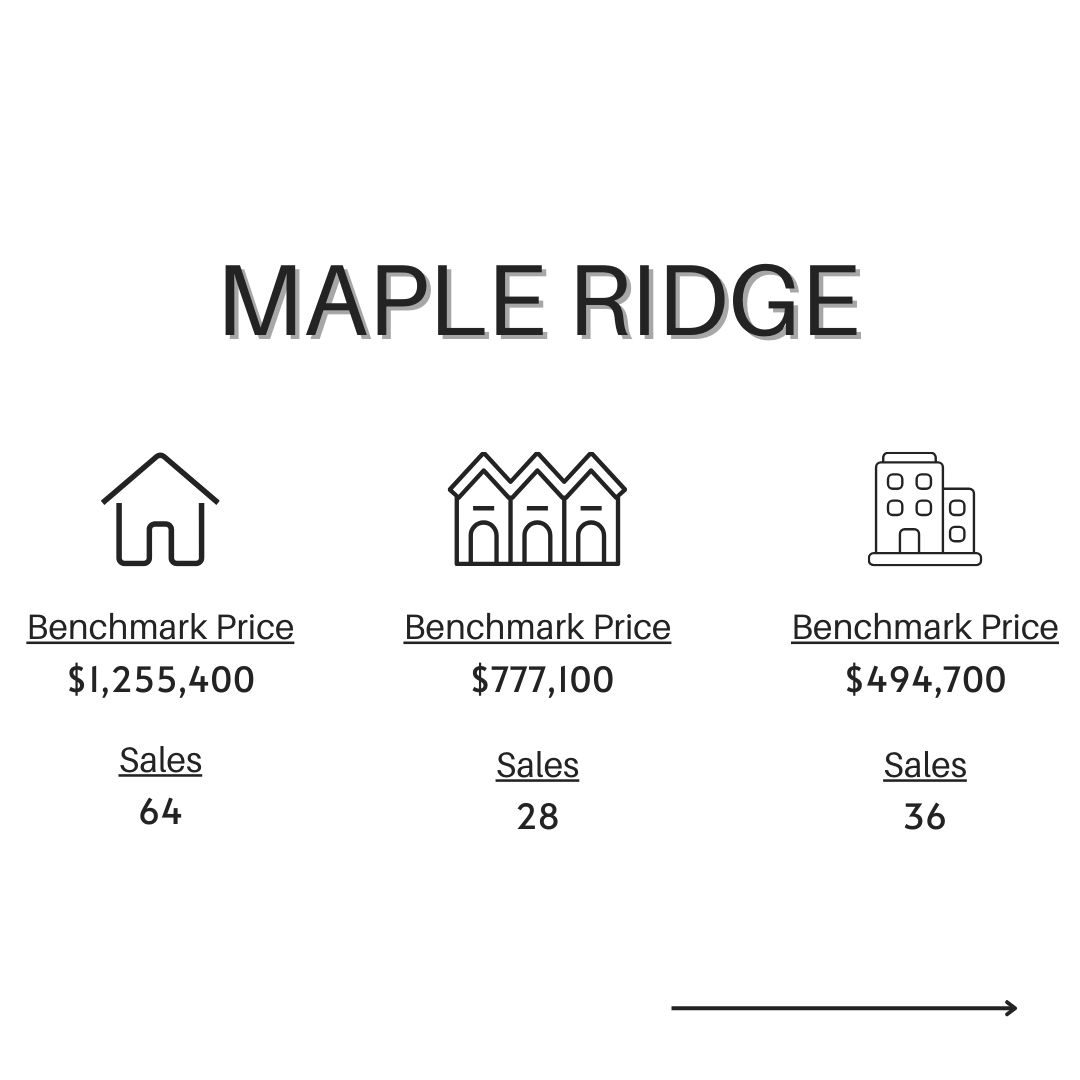

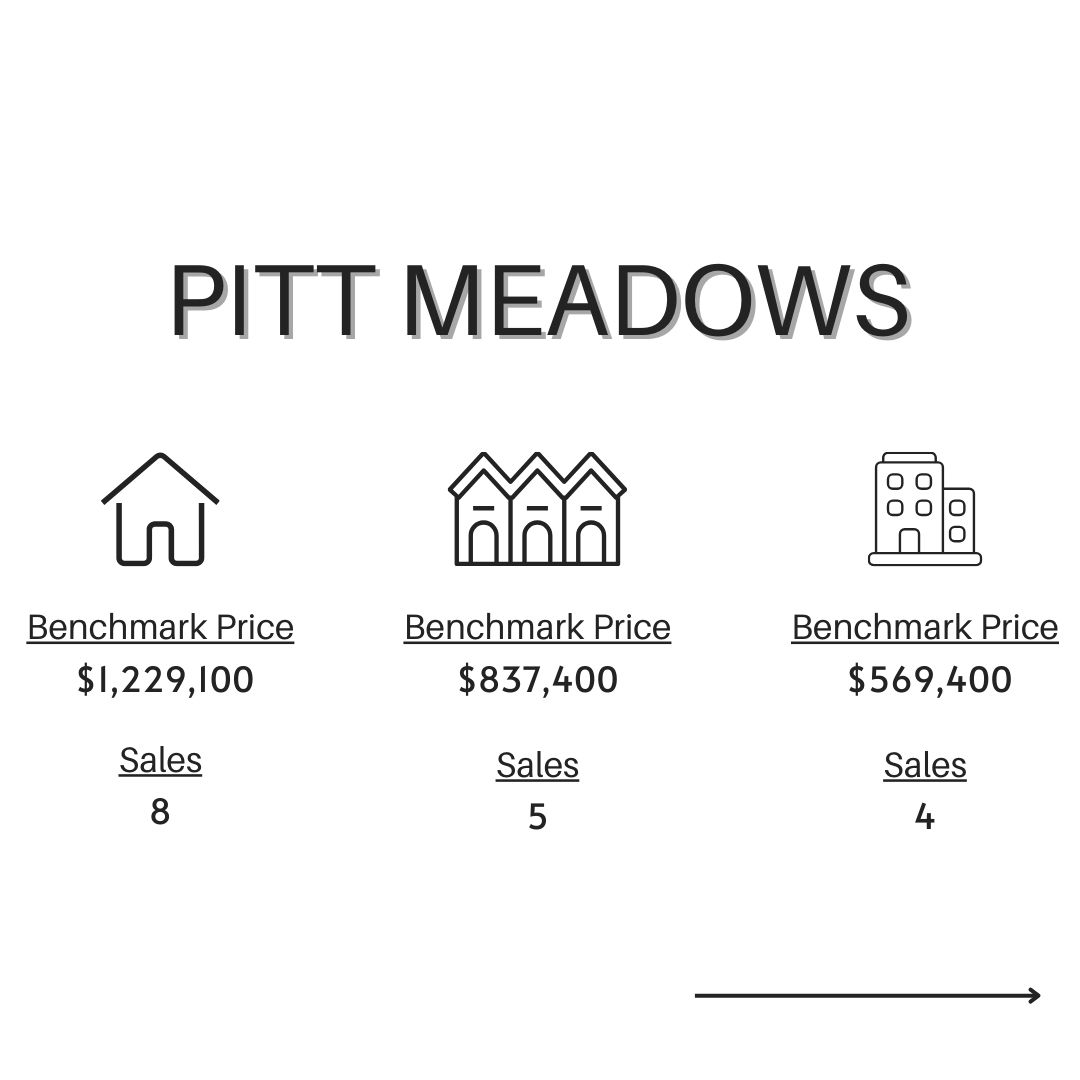

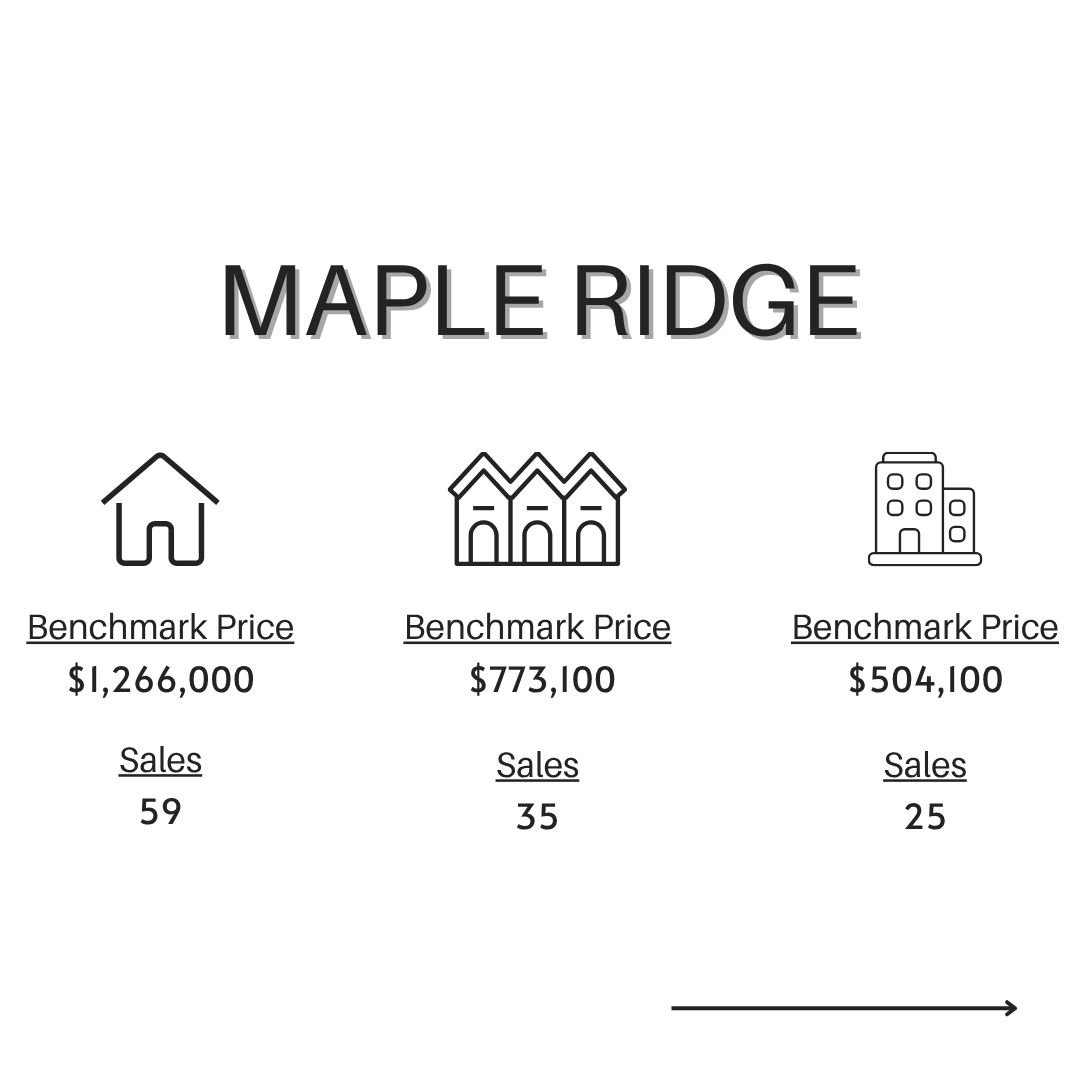

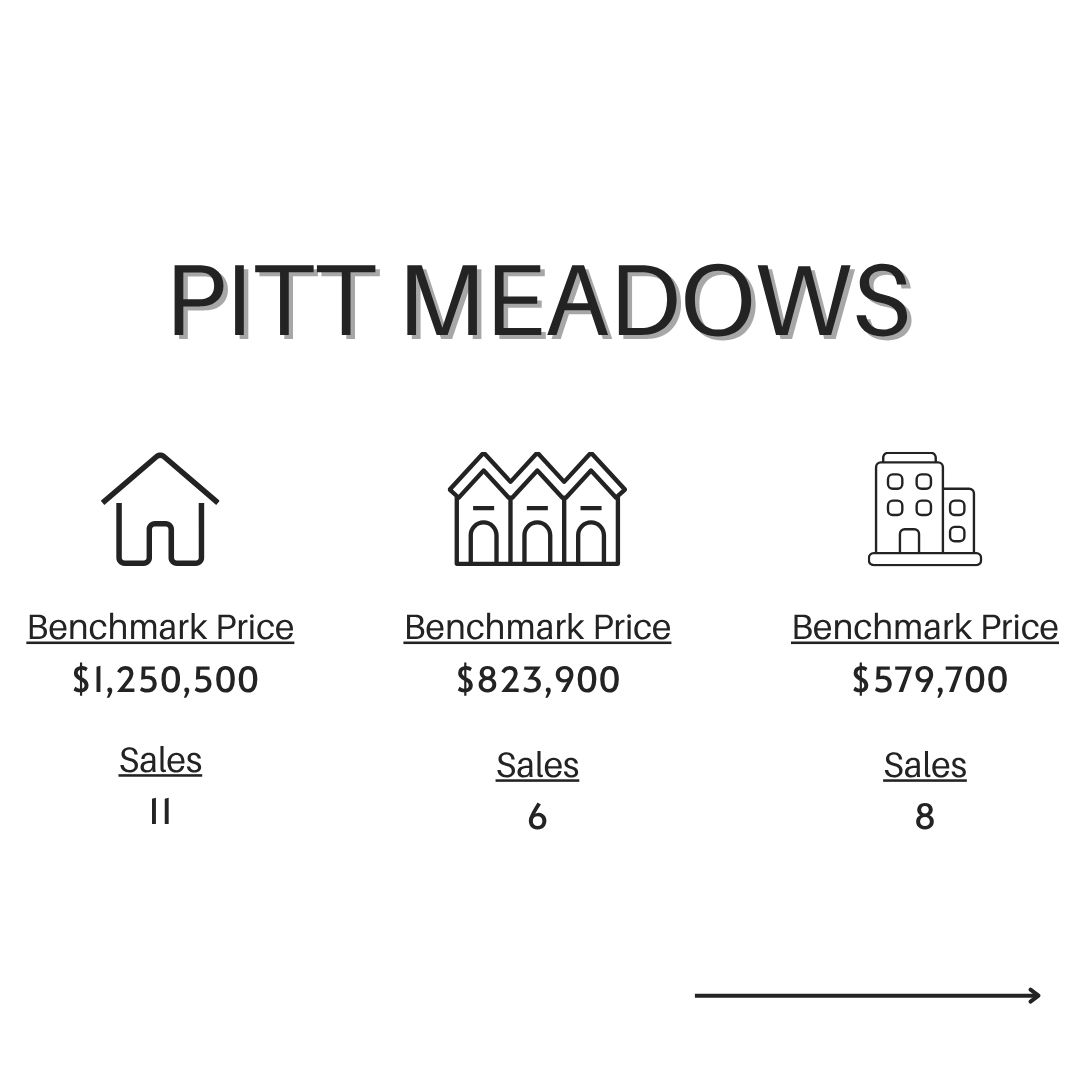

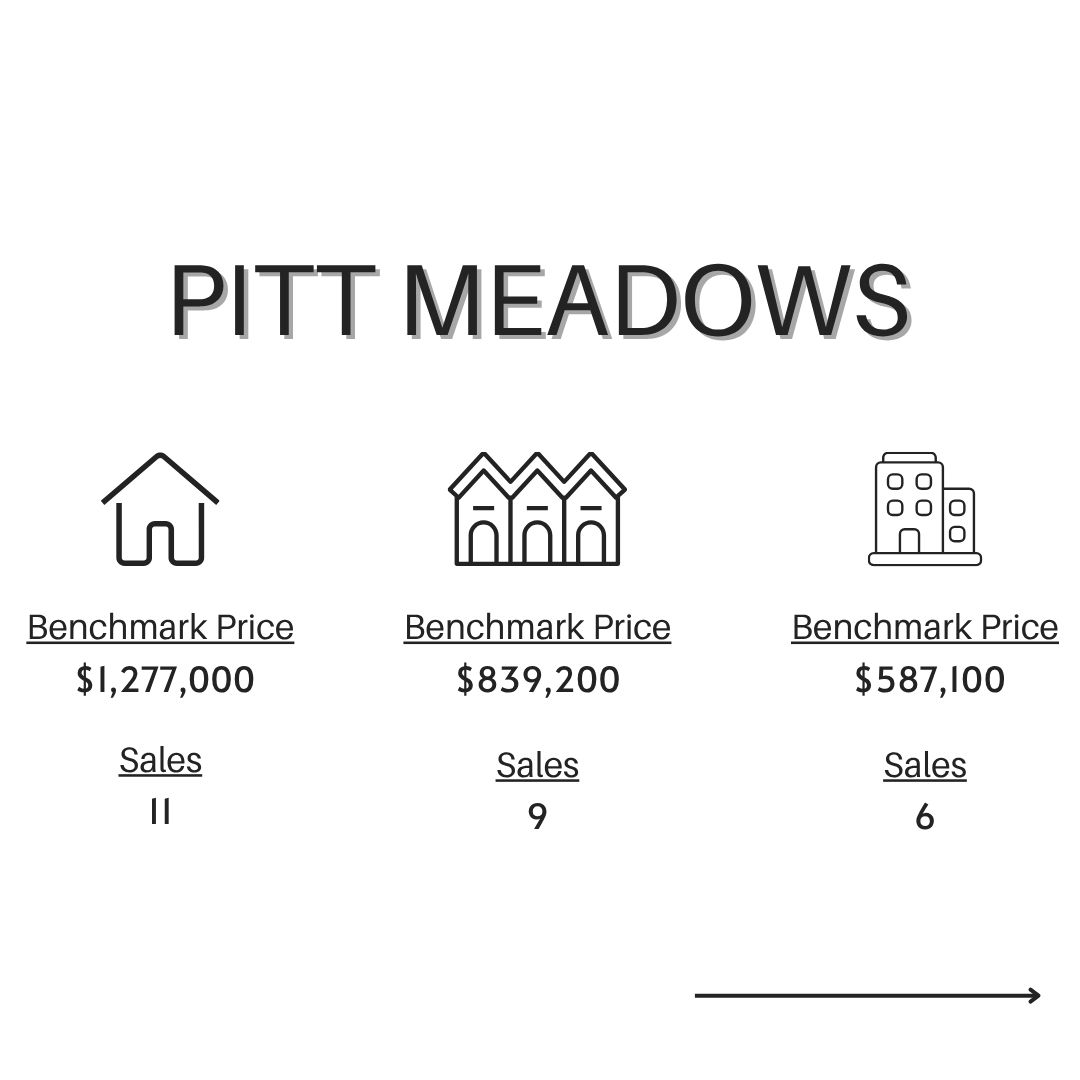

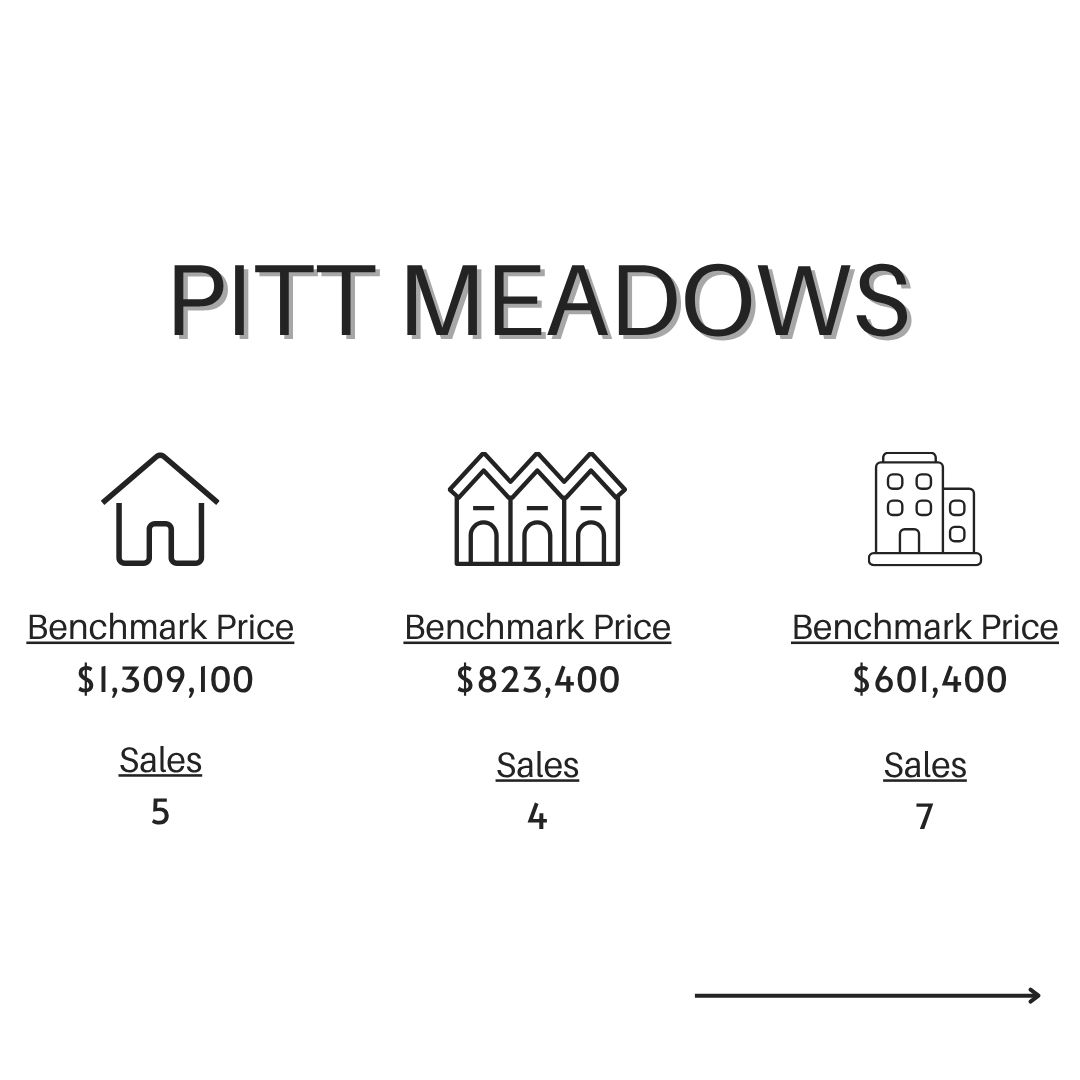

If you’re navigating the Maple Ridge, Pitt Meadows, or Greater Vancouver real estate market, Team Telep is here to help. Contact us for a no-obligation consultation to discuss your real estate goals.

Vancouver Real Estate Market Update – July 2025

Home Sales: 2,286 (-2% YoY)

New Listings: 5,642 (+0.8% YoY)

Total Listings: 17,168 (+19.8% YoY)

Benchmark Price: $1.165M (-2.7% YoY, -0.7% MoM)

Market Insights:

Sales-to-active listings ratio: 13.8% → Balanced market

Detached home price: $1.974M (-3.6% YoY)

Apartment price: $743K (-3.2% YoY)

Attached home price: $1.099M (-2.3% YoY)

2025 Outlook:

Sales activity showed signs of recovery in June, with July data confirming the upward trend. The Bank of Canada’s decision to hold rates steady may boost buyer confidence amid ongoing trade uncertainty. New listings remained stable, keeping MLS® inventory at around 17,000 homes—providing ample choice for buyers. As the market rebounds, this balanced supply is expected to keep prices steady in the short term.

If you’re navigating the Maple Ridge, Pitt Meadows, or Greater Vancouver real estate market, Team Telep is here to help. Contact us for a no-obligation consultation to discuss your real estate goals.

🏡 Vancouver Real Estate Market Update – June 2025 📊

🔹 Home Sales: 2,181 (-9.8% YoY)

🔹 New Listings: 6,315 (+10.3% YoY)

🔹 Total Listings: 17,561 (+23.8% YoY)

🔹 Benchmark Price: $1.173M (-2.8% YoY, -0.3% MoM)

📉 Market Insights:

▪️ Sales-to-active listings ratio: 12.8% → Balanced market

▪️ Detached home price: $1.994M (-3.2% YoY)

▪️ Apartment price: $748K (-3.2% YoY)

▪️ Attached home price: $1.103M (-3% YoY)

📊 2025 Outlook:

After a slow start to the year, Metro Vancouver MLS® home sales are showing signs of recovery. June sales were down 10% year-over-year, half the decline seen in May—pointing to a possible turnaround as buyer demand begins to strengthen.

If you’re navigating the Maple Ridge, Pitt Meadows, or Greater Vancouver real estate market, Telep Team is here to help. Contact us for a no-obligation consultation to discuss your real estate goals.

🏡 Vancouver Real Estate Market Update 📊

🔹 Home Sales: 2,228 (-18.5% YoY)

🔹 New Listings: 6,620 (+3.9% YoY)

🔹 Total Listings: 17,094 (+25.7% YoY)

🔹 Benchmark Price: $1.177M (-2.9% YoY, -0.6% MoM)

📉 Market Insights:

▪️ Sales-to-active listings ratio: 13.4% → Balanced market

▪️ Detached home price: $1.997M (-3.2% YoY)

▪️ Apartment price: $757K (-2.4% YoY)

▪️ Attached home price: $1.106M (-3.4% YoY)

📊 2025 Outlook:

With strong inventory levels, sellers are more flexible on pricing, giving buyers more room to negotiate and keeping prices stable. After a slow spring, summer could see a boost in activity, and the market continues to favor buyers—great news for those ready to purchase.

If you’re navigating the Maple Ridge, Pitt Meadows, or Greater Vancouver real estate market, Telep Team is here to help. Contact us for a no-obligation consultation to discuss your real estate goals.

.png?cc=1699463427848)

An increase in newly listed properties is providing more choice to home buyers across Metro Vancouver, but sales remain below long-term averages.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential sales in the region totalled 1,996 in October 2023, a 3.7 per cent increase from the 1,924 sales recorded in October 2022. This total is 29.5 per cent below the 10-year seasonal average (2,832) for October.

“With properties coming to market at a rate roughly five per cent above the ten-year seasonal average, there seems to be a continuation of the renewed interest on the part of sellers to participate in the market that we’ve been watching this fall,” Andrew Lis, REBGV’s director of economics and data analytics said. “Counterbalancing this increase in supply, however, is the fact sales remain almost 30 per cent below their ten-year seasonal average, which tells us demand is not as strong as we might expect this time of year.”

Want to know what your home is worth and if it's the right time for YOU to sell? Give ua a call today!

.png)

%20(1).png)

%20(2).png)